400,000 Call on Congress to Freeze Rent/Mortgage/Utility Payments for American Families

ParentsTogether survey indicates half of families already can’t afford basic necessities

New York, NY — As millions of families struggle to pay their bills as a result of the coronavirus pandemic, 403,525 people have signed a petition created by ParentsTogether Action calling on Congress to suspend rent, mortgage, and utility payments, and order a full moratorium on evictions/foreclosures.

ParentsTogether Action, a national parent-led organization with over 2 million members, has also released a survey of 1,200 families around the country regarding the impact the coronavirus crisis is having nationwide. The results found that nearly half of families have already lost income and that the majority of families won’t be able to pay their rent/mortgage bills this month without cutting back on other basics like food.

“The stimulus bill is a first step, but it’s not enough for most families and leaves out many altogether. Millions are wondering how they’ll pay their rent or mortgage by tomorrow. We need additional emergency action suspending rent, mortgage and utility payments for the duration of this crisis,” said Justin Ruben, Co-Director of ParentsTogether. “Parents are telling us they won’t be able to pay rent unless they cut back on vital food or medication — this isn’t a choice we should be forcing people to make.”

Below, please find topline findings from ParentsTogether Action’s survey of more than 1,200 parents and ParentsTogether members.

- 68% of families are struggling as a result of the coronavirus outbreak. Between March 18 to March 26, the percentage of families surveyed with children under 18 who have lost income increased from 33% to 48%. (See results from March 18.)

- Only 38% say they’ll be able to pay their rent/mortgage on April 1 in full, without cutting back on other necessities like food. Just 30% are confident they’ll be able to pay their May rent/mortgage.

- Half of families are already having to trade off between paying for basics like rent, utilities, healthcare, or food.

- 82% of respondents are worried about having enough money to cover basic housing and food costs within three months. 46% are worried about running out within the next two weeks.

- Over two-thirds of respondents say that the emergency one-time payment coming to many Americans will help tide them over for a month or less.

“The rescue bill that just passed is helpful but much more is needed. The effects of this pandemic will be felt long past the summer—and the bill left out wide swaths of the population altogether. People who can’t work because they need to do childcare, immigrant workers, new entrants to the workforce, and others need help that, right now, isn’t coming,” said Ruben.

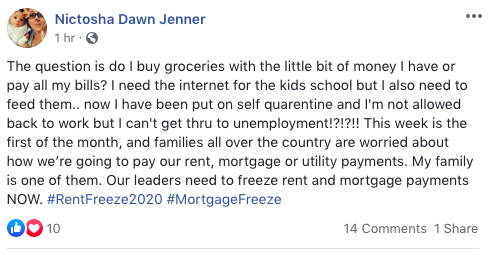

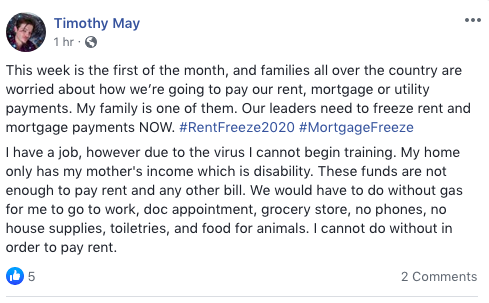

People around the country are sharing their stories about the bills they face and can’t pay by April 1 using the hashtags #RentFreeze2020 and #MortgageFreeze. See below for examples.

As a resource to parents in the very short term, the organization has launched Coronavirus Parents, a Facebook group where parents are sharing resources, ideas, small victories and strategies for getting through the crisis.

Below, please find a sampling of testimonials from respondents:

“My husband is the sole provider and lately his job has been slow. He usually works overtime to make rent, but lately there has not been any calls after hours and his job has been sending them home early. Do we save money for rent or do we buy food? Of course we have to feed our children so we go and buy food.”

– Patty, CA

“We’re just paying for food, supplements and basics at the moment, not paying any bills except for a loan from a family friend … Our credit cards don’t have much credit left on them. We have filled out necessary paperwork to our mortgage company but haven’t heard back. We have two special needs children that I already homeschool. But we have no health insurance and didn’t qualify for Medicaid. We are just relying on pure faith at this point.”

– Josephine, FL

“I’m a server and my hours have been seriously cut. There’s been no customers to serve. My husband was laid off 2 days ago…I can either buy food for my family, pay my car payment, and car insurance or pay a portion of my rent. There’s no way I can pay for all of it. I’ve lost 75 percent of my income.”

– Ange, GA

“My husband and I have gone without food in order to purchase my seizure medication…We are retired and our only income is from one rental property that is currently rented to a single mom who lost her job as a waitress. She has notified us that she is unable to pay rent. We are not about to even think of evicting her. However that Ieaves us without any income.”

– Bobbie, OR

“My medication is expensive and the first thing I stop buying, then food. We’ll definitely be missing meals and I’ll have to ration medication to make it last longer until I can buy more.”

– Ursula, FL

“I don’t have enough money to go around. I live paycheck to paycheck so I have to decide if I want to eat or pay my bills.”

– Christie, IN

Full Results

Do you feel like your family is struggling as a result of this crisis?

What concerns do you have in this moment? (select all that apply)

Have you lost income or do you expect to soon?

Many of us are concerned about having enough money for food or housing. If things don’t improve, are you worried about covering basic costs?

How likely are you to be able to pay your rent/mortgage/utilities on April 1?

How likely are you to be able to pay your rent/mortgage/utilities on May 1?

Due to loss of income, are you having to trade off right now between paying for basics like rent or utilities or health care or food?

The government is working to pass a bill that would send a one-time emergency payment of $1200 to most adults, and $500 for most kids. Given your monthly expenses and lost income, how much would a payment of that size help? It would: